Whatever You Needed To Understand About House Mortgages

Written by-Lehmann AdlerAre you planning to buy a new home? Or is your current mortgage too high thanks to the slumping economy? Do you need to refinance or take on a second mortgage to complete work on your home? No matter what reason you have for seeking a mortgage, this article has what you need to know.

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. A good idea is for you to try to improve your credit before you apply for mortgage loan.

Try getting yourself pre-approved for loan money, as it will help you to better estimate the mortgage payment you will have monthly. Look around so you know what your price range is. Once you find out this information, you can easily calculate monthly payments.

Do not take out new debt and pay off as much of your current debt as possible before applying for a mortgage loan. Low consumer debts will make it easier to qualify for the home loan you want. High consumer debt could lead to a denial of your mortgage loan application. It might also make your rates so high you cannot afford it.

For friends who have already went through the mortgage process, ask them how it went. They will probably have some great suggestions and a few warnings as well. You can avoid bad situations by learning from their negative experiences. The more people you speak with, the more you'll learn.

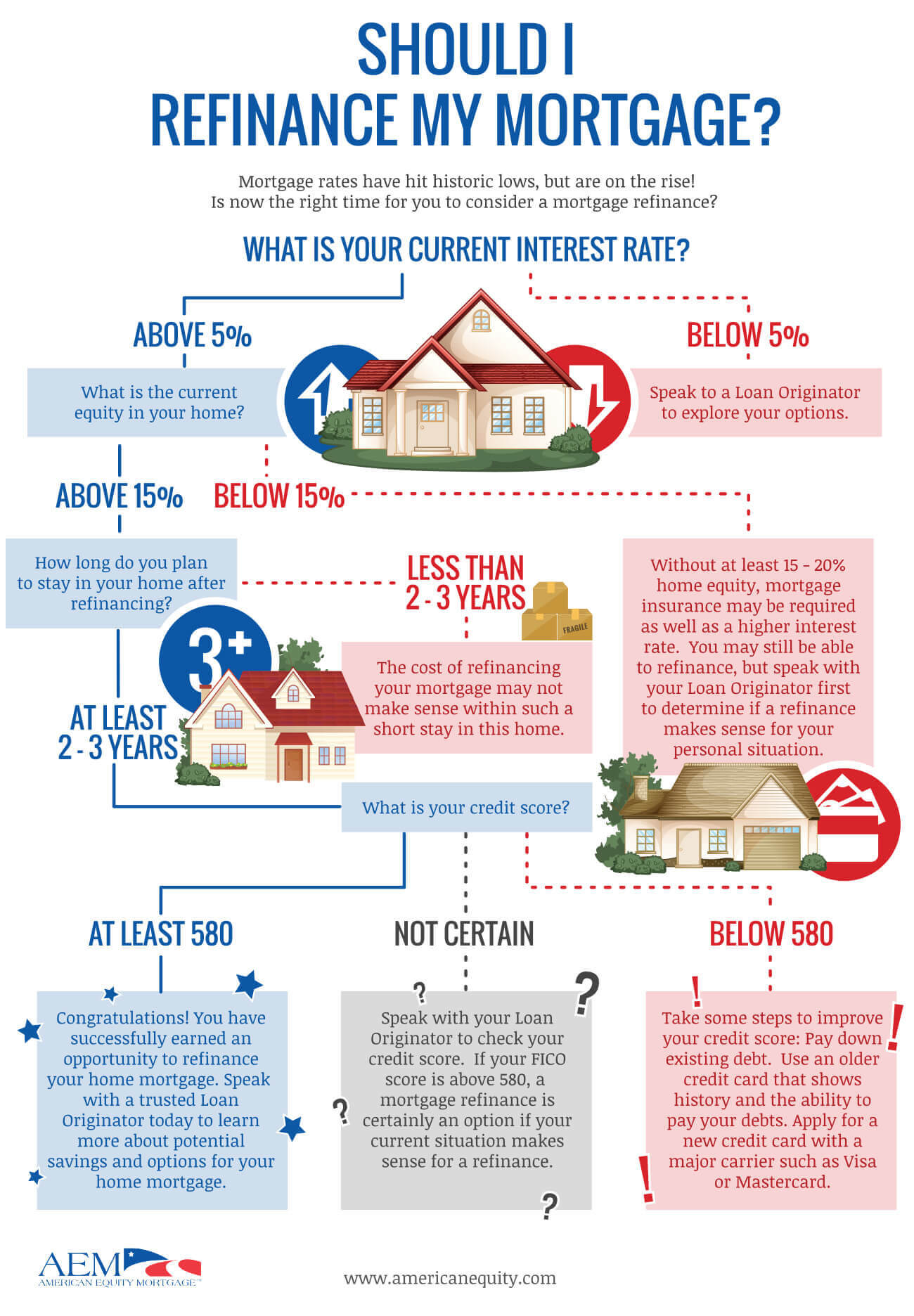

Refinancing a home mortgage when interest rates are low can save you thousands of dollars on your mortgage. You may even be able to shorten the term of your loan from 30 years to 15 years and still have a monthly payment that is affordable. You can then pay your home off sooner.

A fixed-interest mortgage loan is almost always the best choice for new homeowners. Although most of your payments during the first few years will be heavily applied to the interest, your mortgage payment will remain the same for the life of the loan. Once you have earned equity, you may be able to refinance your loan at a lower interest rate.

Hire an attorney to help you understand your mortgage terms. Even those with degrees in accounting can find it difficult to fully understand the terms of a mortgage loan, and just trusting someone's word on what everything means can cause you problems down the line. Get an attorney to look it over and make everything clear.

Speak with many lenders before selecting the one you want to borrow from. Ask about all fees and charges. Find reviews about different lenders online and speak to family and friends. Once you have a complete understand of what each offers, you can make the right choice.

Find out how https://www.cnet.com/personal-finance/venmo-settings-to-change-asap-start-by-making-your-transactions-private/ will be making off of the transaction. Many times mortgage broker commissions are negotiable just like real estate agent commissions are negotiable. Get this information and writing and take the time to look over the fee schedule to ensure the items listed are correct.

Save up enough so you can make a substantial down payment on your new home. Although it may sound strange to pay more than the minimum required amount for the down payment, it is a financially responsible decision. You are paying a lot more than the asking price for the home with a mortgage, so any amount that you pay ahead of time reduces the total cost.

Many people do not have excellent credit. When you are applying for a mortgage is not the time to find out. Check your credit report before applying for a mortgage. Clear up any issues that you may have with the credit agency. This will help you when it comes time to find a mortgage for your home.

Determine what kind of mortgage you are going to need. There are many to choose from. When you know about the different kinds and compare them, that will make it easier to choose the kind of mortgage that is right for you. Speak with your lender about the different types of mortgage programs that are out there.

If you are a retired person in the process of getting a mortgage, get a 30 year fixed loan if possible. Even though your home may never be paid off in your lifetime, your payments will be lower. Since you will be living on a fixed income, it is important that your payments stay as low as possible and do not change.

Keep your credit score in good shape by always paying your bills on time. Avoid negative reporting on your score by staying current on all your obligations, even your utility bills. Do take out credit cards at department stores even though you get a discount. You can build a good credit rating by using cards and paying them off every month.

Opt out of credit offers before applying for a home mortgage. Many times creditors will pull a credit file without your knowledge. This can result in an immediate decline for a home mortgage. To help prevent this from happening to you, opt out of all credit offers at least six months before applying for a loan.

Save up lots of money ahead of applying for your mortgage. You will probably have to pay at least three percent down. Paying more is better, though. You need to pay the private mortgage insurance if there are down payments of less than 20%.

Be honest when it comes to reporting your financials to a potential lender. Chances are the truth will come out during their vetting process anyway, so it's not worth wasting the time. And if https://techcrunch.com/2021/06/22/airbank-centralizes-all-your-business-bank-accounts-and-financial-data/ does go through anyway, you'll be stuck with a home you really can't afford. It's a lose/lose either way.

During the process of obtaining a mortgage loan, submit any requested documents to your mortgage broker or lender as soon as possible. Taking your time to respond to your lender can delay the date of the closing. Delaying the closing date can put you at risk of losing the rate you have locked-in.

You must take the time to learn how to obtain the home loan that is right for you before applying for one. You want to find a home you can afford at the best rate possible for your situation. You don't want a home you can't afford. In the end, what you want is a home you can enjoy for years and a lender who is understanding and fair.